Global Mining Industry Analysis: Market Capitalization and Regional Dominance

Xuan-Ce Wang

2/13/20254 min read

Executive Summary

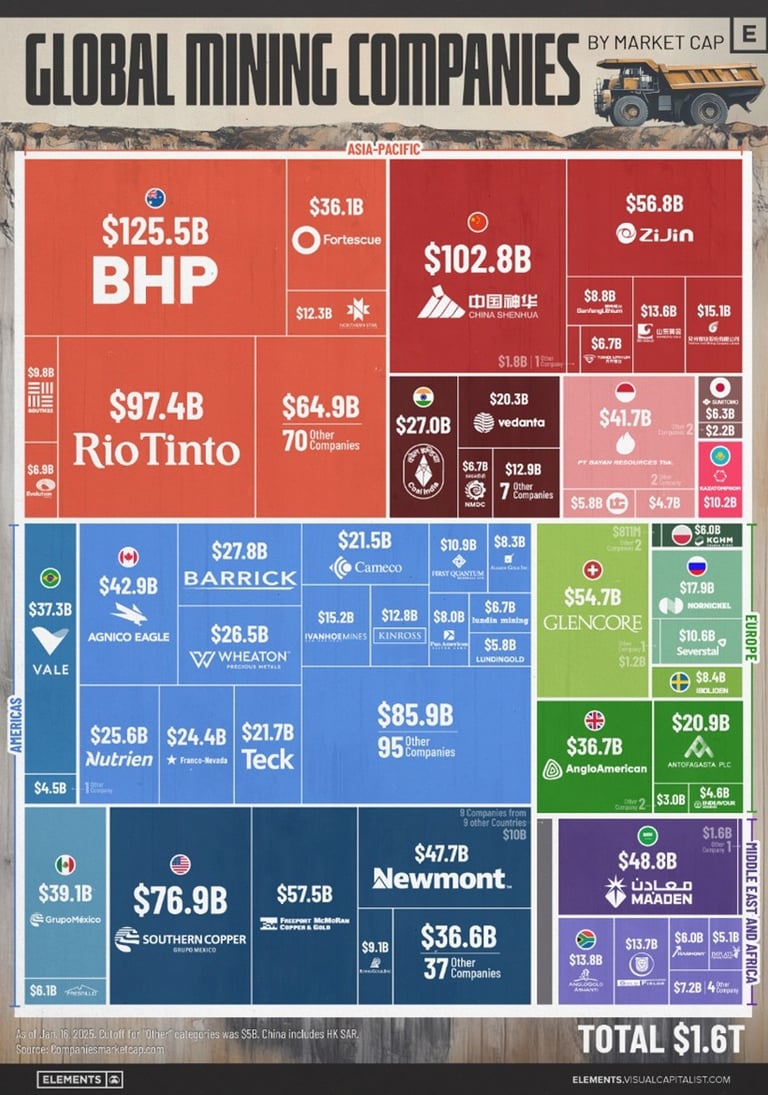

The global mining industry, valued at $1.6 trillion by market capitalization, shows strong regional concentration and significant growth potential in key sectors. Key findings include:

Market Leadership

Australia dominates with $353 billion total market cap, led by BHP ($125.5B) and Rio Tinto ($97.4B)

Canada follows at $344 billion, with strong representation in precious metals

China and the United States rank third and fourth with $206B and $228B respectively

Sector Performance

Gold sector shows robust reserves with major players holding over 69 million ounces

Copper sector anticipates supply gaps by 2025 due to EV demand

Strategic metals gaining importance for energy transition

Growth Outlook

Over $10 billion in major project investments underway

Significant expansion in both precious metals and copper production

Focus on technological innovation and sustainability

Key Challenges

Environmental permitting becoming more stringent

Water management and energy transition requirements

Social license to operate increasingly critical

This analysis indicates a strong industry position with significant growth potential, particularly in metals critical for global energy transition.

The global mining industry continues to demonstrate significant economic power, with a total market capitalization reaching $1.6 trillion as of January 2025. This analysis explores the key players, regional distributions, and notable trends shaping the industry landscape.

1. Regional Powers: Australia and Canada Lead the Pack

Australia emerges as the dominant force in global mining, with its major mining companies accumulating a staggering $353 billion in market capitalization. The country's supremacy is largely attributed to two mining giants:

BHP ($125.5B) - The world's largest mining company by market cap

Rio Tinto ($97.4B) - The second-largest Australian mining corporation

This leadership position is no coincidence. Australia's vast mineral wealth, particularly in iron ore and lithium, has positioned it as a crucial supplier for both traditional steel production and emerging battery technologies.

Canada's Strong Second Position

Canada secures its position as the second-largest mining jurisdiction globally, with a combined market capitalization of $344 billion. Notable Canadian companies include:

Barrick Gold ($27.8B)

Agnico Eagle ($42.9B)

Wheaton Precious Metals ($26.5B)

Nutrien ($25.6B)

The country's success stems from its diverse mineral portfolio, with particular strength in gold, copper, nickel, and potash mining operations.

The Rise of China and Emerging Markets

The Asia-Pacific region shows remarkable strength, particularly through Chinese mining giants:

Zijin Mining ($56.8B)

China Shenhua ($102.8B)

These companies reflect China's growing influence in the global mining sector, with a total market capitalization of $206 billion for Chinese mining companies.

2. Corporate Concentration and Market Structure

The industry shows significant concentration among top players:

The top 5 companies account for nearly 30% of the total market capitalization

BHP alone represents approximately 7.8% of the global mining market cap

Regional consolidation is evident, with major players dominating their home markets

3. Precious Metals and Copper Sector Analysis

The precious metals and copper sectors represent a significant portion of the global mining market capitalization, with several key players dominating these segments:

Gold Mining Leaders

Barrick Gold ($27.8B) stands as one of the largest gold mining companies, with extensive operations across multiple continents

Newmont ($47.7B) maintains its position as a premier gold producer with a robust project pipeline

Gold Fields ($13.7B) continues to be a major player in the gold sector, particularly in Africa

Agnico Eagle ($42.9B) demonstrates strong performance in the gold sector with operations primarily in Canada

Wheaton Precious Metals ($26.5B) operates a successful streaming and royalty business model in the precious metals space

Copper Mining Giants

Southern Copper ($76.9B) emerges as a dominant force in copper mining, particularly in Latin America

Freeport-McMoRan ($57.5B) maintains significant copper operations globally

First Quantum ($10.9B) operates major copper projects with a focus on operational efficiency

Vale ($37.3B), while diversified, has substantial copper mining operations alongside its iron ore business

Production Volumes and Reserves

Gold Sector

Newmont leads global gold production with approximately 6 million ounces annually

Barrick Gold maintains reserves of over 69 million ounces of proven and probable gold

Agnico Eagle expects to produce 3.35-3.55 million ounces of gold annually

Gold Fields operates with approximately 50 million ounces of gold reserves across its global portfolio

Copper Sector

Southern Copper holds the largest copper reserves globally, with over 67 million tonnes

Freeport-McMoRan produces approximately 4.2 billion pounds of copper annually

First Quantum operates with production capacity of about 800,000 tonnes per year

Vale contributes around 350,000 tonnes of copper production annually

Future Growth Projects

Gold Development Pipeline

Newmont's Yanacocha Sulfides project in Peru represents a $2.5 billion investment

Barrick Gold's Reko Diq project in Pakistan aims to produce 200,000 ounces annually

Agnico Eagle is expanding the Kittilä mine in Finland, targeting 30% production increase

Gold Fields' Salares Norte project in Chile is expected to add 450,000 ounces annually

Copper Expansion Initiatives

Southern Copper's Michiquillay project in Peru targets 225,000 tonnes annual production

Freeport-McMoRan's Grasberg underground transition represents a major growth driver

First Quantum's Cobre Panama expansion aims to increase capacity to 100 million tonnes per year

Vale's Salobo III expansion project targets increased copper production in Brazil

Industry Dynamics and Future Outlook

The copper sector anticipates supply gaps by 2025 due to electric vehicle demand growth

Gold producers are focusing on operational efficiency and reserve replacement

Companies are increasingly investing in automation and digital technologies

Environmental permits and social licenses are becoming critical for project development

Water management and renewable energy integration are key focus areas

Many companies are pursuing operational integration, combining mining with processing capabilities

ESG considerations are becoming increasingly important in both copper and precious metals operations

4. Geographic Distribution of Market Leaders

The market reveals interesting geographic patterns:

Americas: Strong representation through companies like Southern Copper ($76.9B) and Newmont ($47.7B)

Europe: Glencore ($54.7B) stands out as a major player

Africa: Significant presence through companies like Anglo American ($36.7B) and Gold Fields ($13.7B)

5. Emerging Trends and Future Outlook

Several key trends emerge from the data:

Increasing importance of battery metals and rare earth elements

Strong presence of diversified miners in top positions

Geographic diversification of operations despite home-country headquarters

Growing significance of ESG considerations in market valuations

Conclusion

The global mining industry remains highly concentrated among major players while showing growing geographic diversity. The dominance of Australian and Canadian companies highlights the importance of stable regulatory environments and rich mineral deposits. As the industry evolves to meet new demands for battery metals and maintains traditional mining operations, this structure may continue to shift, particularly with the rising influence of Chinese mining companies.

The total market capitalization of $1.6 trillion underscores the mining sector's crucial role in the global economy, providing essential materials for both traditional industries and emerging technologies. The industry's future will likely be shaped by the increasing demand for critical minerals essential for the green energy transition, while maintaining its traditional base in precious metals and bulk commodities.