Silver Production in Q4 2024 — Key Highlights and Trends

Xuan-Ce Wang

3/2/20252 min read

Executive Summary

The fourth quarter of 2024 saw significant shifts in global silver production, marked by surging output from major miners like Newmont Corporation and Pan American Silver, alongside challenges for producers facing operational disruptions. While overall supply growth was driven by mine expansions, acquisitions, and improved infrastructure, declining ore grades and labor disputes weighed on some operators. Below, we analyze production figures, year-over-year (YoY) trends, and key drivers shaping the silver market.

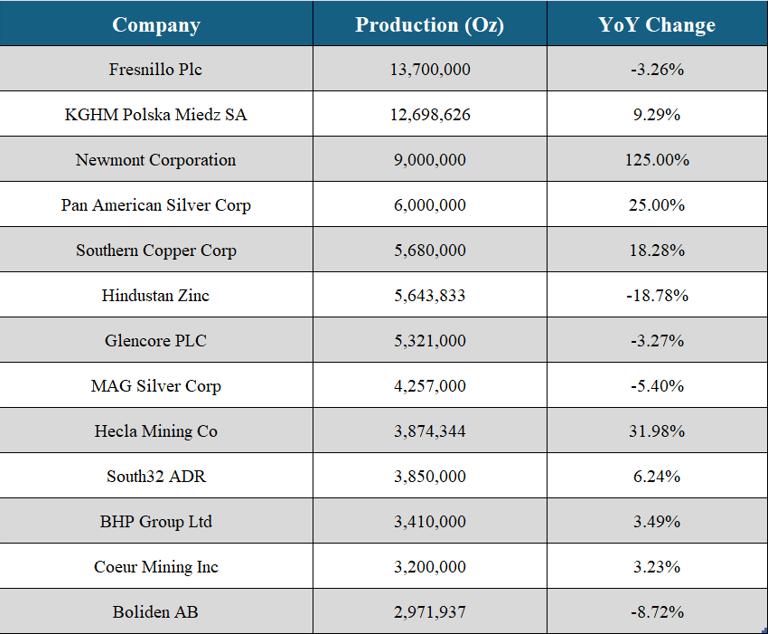

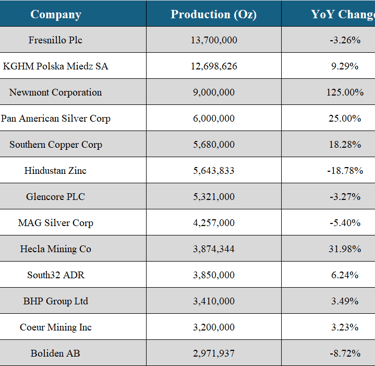

Top Silver Producers in Q4 2024

1. Fresnillo Plc

Production: 13.7M oz (-3.26% YoY)

Key Factors: Closure of San Julián DOB mine, lower ore grades at Fresnillo and Juanicipio, and reduced ore processing. Partial offsets from higher grades at San Julián Veins and Saucito, plus full-year operations at Juanicipio.

2. KGHM Polska Miedz SA

Production: 12.7M oz (+9.29% YoY)

Key Factors: Increased charge material availability at the Głogów Copper Smelter’s Precious Metals Plant, boosting processing capacity.

3. Newmont Corporation

Production: 9.0M oz (+125% YoY)

Key Factors: Resolved labor strikes at Mexico’s Peñasquito mine (Chile Colorado pit) and acquisition of Newcrest Mining (adding Cadia mine assets).

4. Pan American Silver Corp

Production: 6.0M oz (+25% YoY)

Key Factors: Operational upgrades at La Colorada (59% output surge post-ventilation improvements) and contributions from Yamana Gold assets.

5. Southern Copper Corp

Production: 5.68M oz (+18.28% YoY)

Key Factors: Broad-based output growth across operations, excluding Toquepala mine.

Companies Facing Production Declines

1. Hindustan Zinc

Production: 5.64M oz (-18.78% YoY)

Key Factors: Mining sequence changes at SK mine reduced silver input (linked to lead ore extraction challenges).

2. Glencore PLC

Production: 5.32M oz (-3.27% YoY)

Key Factors: Minor operational setbacks across assets.

3. MAG Silver Corp

Production: 4.26M oz (-5.40% YoY)

Key Factors: Lower ore grades at Juanicipio (shared with Fresnillo).

4. Boliden AB

Production: 2.97M oz (-8.72% YoY)

Key Factors: Operational inefficiencies and reduced output.

Notable Performers & Emerging Trends

1. Hecla Mining Co

Production: 3.87M oz (+31.98% YoY)

Key Factors: Lucky Friday mine’s post-fire recovery, strong output at Greens Creek, and Keno Hill contributions. Achieved second-highest annual silver production in 2024.

2. Nexa Resources SA & SSR Mining Inc

Growth: +11.11% and +7.65% YoY, respectively.

3. Moderate Gains:

South32 ADR (+6.24%), BHP Group (+3.49%), Coeur Mining (+3.23%).

Market Implications

Supply Dynamics: Q4 production growth reflects strategic expansions (e.g., Newmont’s acquisitions) and infrastructure upgrades. However, declining ore grades and labor issues highlight systemic risks.

Price Impact: Higher silver prices in 2024 incentivized output recovery at mines like Lucky Friday.

Strategic Moves: Consolidation (e.g., Newmont-Newcrest) and asset optimization (e.g., Pan American’s La Colorada) are reshaping supply chains.

Silver Production Table: Q4 2024

Looking Ahead

The silver market remains bifurcated, with top-tier miners leveraging scale and acquisitions to drive growth, while smaller players grapple with operational headwinds. Rising demand from renewable energy and tech sectors may tighten supply, particularly if production discipline (e.g., DRC-style export halts in cobalt) emerges in oversupplied markets.

Data as of Q4 2024 | Analysis by GeoVision AI